Forecasting is hard. Especially when pipeline data is inaccurate, the sales team is being overly optimistic about the deals they are committing to, and the data structure is not set up to provide quick and actionable insights. To help sales leaders achieve better forecasting, we sat down with Founder & CEO, Craig Jordan, Co-Founder & CRO of GetAccept, Carl Carrel, and the Founder & CEO of Dooly, Kris Hartvigsen. From their conversation, we have compiled these eight sales forecasting best practices, so that sales leaders can achieve better predictability.

Sales Forecasting Best Practices

Forecasting is hard. Especially when pipeline data is inaccurate, the sales team is being overly optimistic about the deals they are committing to, and the data structure is not set up to provide quick and actionable insights. Yet with how challenging forecasting can be there is often so little coaching done on it. Which is why our panel addressed this first.

#1 Coach your team on forecasting

Sales leaders are so often focused on coaching their team how to sell that they do not spend the time that they probably should be on forecasting. Have you modeled and taught your team on what it actually means to commit to a deal? What does each deal stage mean? What are the milestones that need to happen in each stage before a deal is moved to the next one? What does each level of probability mean? If you have forecasting categories, what do each one of those mean?

“In general, sales leaders don’t do a very good job in teaching people the art of forecasting. There is so much more time spent on teaching how to sell rather than walking the sales rep through a deal, dissecting it and explaining why it is missing critical milestones. Walk your sales team through deals highlighting why some closed and why some did not. This can be used as a part of your enablement practice and broader education to talk about forecasting as a part of their job and why it’s important.”

—Kris Hartvigsen

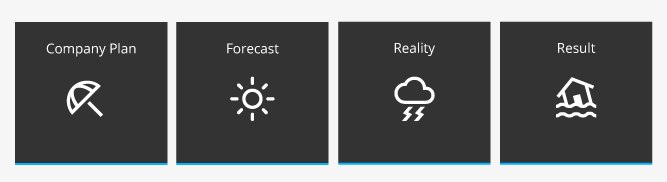

Once those definitions are established and understood, take the time to analyze different deals with your team. Explain to them why certain ones are not forecastable yet. Review deals that have already closed and discuss why certain deals were won and why certain ones were lost. Look for common identifiers (fig.1) of the deals that were won versus lost and see if there are predictable indicators that the team can discover for what might suggest that a deal is more likely to be won or lost.

Figure 1, Common Identifiers to Look for During Win / Loss Deal Analysis

Another technique is to have an objective third party whether that be internal or external, interview your customer on why they chose your business versus the other competitors they were evaluating. It can be difficult to understand the whole picture when you are only hearing the reasons why from a single perspective, the sales team member.

As you continue to coach your sales team, a major point to emphasize is why it is so important for them to keep their pipeline data up-to-date and to make sure they are associating the deal with the right amount of probability and forecast category. One piece of advice that Kris Hartvigsen gave was, “to talk about forecasting as a part of their job.” Forecasting does not just fall on the responsibility of the sales leader, it is a team effort.

Leadership needs to be able to project where the company will be with sales quota in future quarters and future years. It is how the company is able to plan for growth. If the company plans for a sunny day at the beach, and the sales leader is under the impression that it is also going to be a sunny day at the beach based on pipeline data, but in reality the forecast is a hurricane, then there’s going to be serious collateral damage for the business because there were no adjustments made along the way to prepare for sales to come in below their number.

The whole sales organization needs to be doing their part to contribute towards accurate pipeline data, so that the whole company can have an accurate understanding of where the team is in terms of hitting their goal. Thus allowing the team to plan accordingly for future quarters and future years.

#2 Examine your leading indicators

While looking at your pipeline data is a big part of forecasting, forecasting starts way earlier in the B2B sales funnel than when an opportunity is created. Your lead generation channels can point to where you can look, but for example, if SEO is a major driver for your business and there has been a drop in the amount of website traffic that your business has had, then this could be a leading indicator and you should check your other lead generation channels to see if a similar drop is happening.

Your goal should be to understand, what numbers does the revenue team need to be hitting at every stage throughout the funnel to hit your overall revenue goal? For example, how many prospects should be generated, Marketing Qualified Leads, Meetings, Sales Qualified Leads, and Opportunities, for you to reach your revenue goal this quarter, next quarter, and the year? Consider how you can use lifecycle stage tracking to achieve better funnel predictability.

“Leading indicator forecasting tells you how many meetings you can predict you may have based on the number of leads coming in and how many deals you can expect in the pipeline based on the amount of meetings you have booked. This will inform you, for example, if you have 20 meetings booked in October, then you can expect a certain number of deals in the pipeline throughout November, December, and January.”

—Craig Jordan

This is where marketing and sales need to be aligned on the same revenue goal. The two departments may be tracking different KPIs, but the two should be aligned on the amount of leads, meetings, pipeline, and revenue that needs to be generated with the combined efforts. This is just for new business. For existing business, the two should also be aligned with customer success, so that they can all collaborate to make sure that the funnel milestones are where they need to be, so that the company succeeds.

Overall, if you are basing your forecasting off of your pipeline alone, then you may have some inaccuracy, because you did not look to see what has been happening with the rest of the funnel.

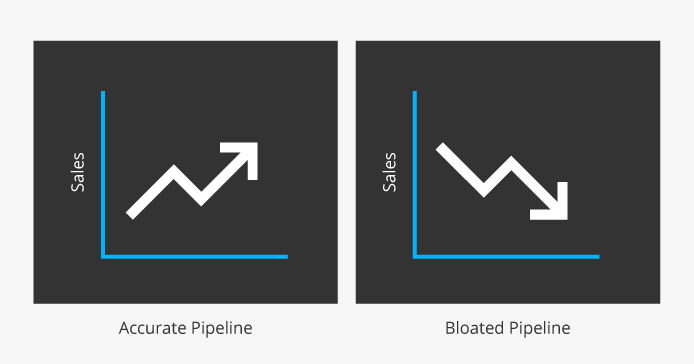

#3 Be diligent in your fight against pipeline bloat

Nothing is worse than when you have a bloated pipeline and the day before the end of the quarter comes and all of a sudden a big portion of your pipeline falls out. Kris Hartvigsen mentioned that when sales are slow, sales reps are more likely to hold onto deals in their pipeline and are willing to take more risk and say that they have a valid deal. However, when sales are going really well, they can only handle so many deals at a time, so they are less likely to hold onto deals in their pipeline that are not actually progressing forward (fig. 2)

Figure 2 The Relationship Between Sales Performance and a Bloated Pipeline

Craig Jordan, advised sales leaders, “Know when to confront your reps. Ask them why they feel so strongly about certain deals.”

Carl Carrell discussed the importance of monitoring your push dates, meaning when an opportunity close date is delayed or pushed further out into the year. If a deal keeps getting pushed out, then the time comes to question whether or not there is an actual opportunity there.

As you use these sales forecasting best practices in your daily habits, coach your team on when they should be removing deals from their sales pipeline to focus on higher priority opportunities that are actually progressing forward.

#4 Use deal milestones in your sales process

Deal milestones are the major actions that need to happen in each deal stage in order for an opportunity to be moved onto the next stage in your sales process.

Some teams will standardize their probability levels on their deals according to the stage that a deal is in. However, if the deal is advanced to a certain stage, but major milestones have not happened for that deal to close successfully, then the forecast data for that particular deal will be inaccurate.

Carl Carell stressed that when sales leaders are coaching their teams and defining what their deal stages are, that they should include the milestones that need to happen within each stage as a part of the conversation.

Therefore go through your sales process and ask, what should be happening at each stage of the sales process? What are the essential actions that need to happen before a deal is moved onto the next stage?

This will help prevent deals getting marked too far along in the sales process prematurely, thus helping to contribute towards a more accurate forecast.

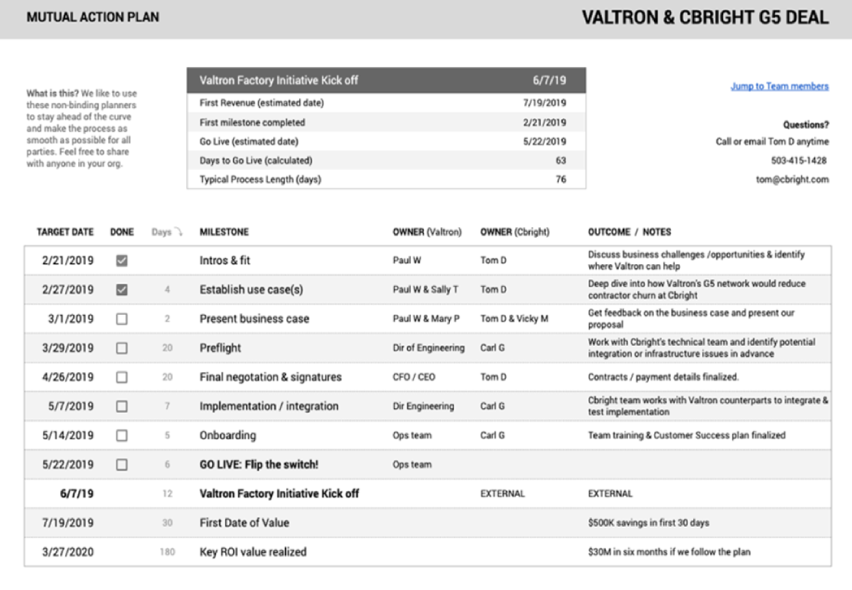

#5 Aligning with buyers with mutual action plans

Craig Jordan shared that a mutual action plan is a roadmap of how the salesperson and the buyer are going to engage throughout the process. It lists out everything that is going to happen throughout the buying process, the actions that will need to be taken by the buyer and the seller, as well as the timeline that everything is going to happen in (fig. 3).

Figure 3 Mutual Action Plan Template (SalesHacker)

The benefits of a mutual action plan for sellers are:

❶ It creates accountability for both parties.

❷ It is a good indicator for how serious the buyer is.

❸ It gives grounds for sales to reach out to the buyer when their actions are being delayed.

A good mutual action plan will also include the customer kick-off date, because if the deal is getting delayed because the buyer is missing deadlines on their end of the mutual action plan, then they should know that their kick-off date is also going to be delayed.

A mutual action plan is not a tool for sales to hang deadlines over a buyer’s head and be pushy, but rather it should come from a place of empathy from one professional to another expressing that they understand the buyer has goals they want to achieve, so to make the most of everyone’s time and be transparent about what needs to happen throughout the buying process, this mutual action plan is being put into practice.

As sellers use the mutual action plan to align with buyers on the close date, it will help reduce the amount of close dates that get pushed out in your pipeline, contributing to a more accurate sales forecast.

#6 Accounting for ramp and attrition when forecasting

When new sales team members come on board, they cannot be expected to contribute a lot to the pipeline that same quarter, unless they are highly experienced and you have a streamlined onboarding process.

Based on the average ramp time from Revenue.io, it takes a B2B sales employee about three months. However, the question then becomes how long does it take for that new salesperson to start performing around the same as your other current sales team members? According to Training Industry, 381 days, more than a year.

Your organization may differ and you may see new sales team members start to perform comparably to veteran ones within six to nine months. The point is to make sure that this lapse in time is accounted for in your forecast.

The other side of this is attrition. HubSpot reported that the average rep turnover rate is 35%. When a rep is working a deal and then churns and that account is handed off to another rep, three things could happen:

❶ The prospect decides to not move forward and the deal is removed from the pipeline.

❷ The opportunity close date gets pushed out as the new account owner is getting acquainted with the prospect.

❸ The opportunity moves forward and keeps the original close date, but this is less likely.

If you know that on average your team has historically had a sales rep turnover rate of a certain percentage, then be sure to take this into consideration as you are framing your forecast.

#7 Adjusting your forecast to shifts in the market

If there starts to be a downturn in the market then you may need to adjust your forecasting. Kris Hartvigsen advised to pay attention to your close rates when market shifts start to happen. Are close rates decreasing, increasing, or staying the same? Close rates are a lagging indicator though and what could be more of a leading indicator are the numbers at the top and middle of the funnel, referenced from sales forecasting best practice #2, examine your leading indicators.

Aside from looking at your close rates, overlay your ICP onto all of your deals. Look at your company’s product market fit and see if it has shifted.

“Evaluate your ICP. Ask yourself, how much risk do you have in the market you’re pursuing? How sensitive are they to the recession that we have entered? Can you change how you target the market? If you have the opportunity to pursue different geographical markets, maybe that’s the answer, or maybe it’s a different industry. Have those considerations to see what changes you could make to hit your number if you are starting to see push rates increase and win rates drop.”

—Carl Carell

Review deals with the team and discuss what buying signals have been occurring in their closed won deals. Are those signals still the same as what you have experienced with your ICP historically? Are you seeing deals delay? Are certain deal stages getting extended? Has your deal velocity slowed?

In addition to discussing the market shifts internally, gather qualitative data in your professional communities that are selling into similar audiences. What are people saying? What is happening?

If all signs are pointing to the fact that your business is going to be affected by a downturn, then you should have that discussion with leadership and say, this is what we are hearing, this is what is happening, and we should consider tempering our forecast or else you may be marginally or wildly off.

#8 Start simple

If you are at an early stage company and are looking to build out your forecasting framework and are wondering where to start, the resounding advice that came across the panel was, “Start simple.”

The below is a checklist of the beginning structures to aim for when you are first getting started with building out your sales forecasting.

❶ Have your sales process defined including the stages and the milestones.

❷ Coach your team on what the deal stages and milestones mean and how their pipeline data contributes to the forecast.

❸ Gather a baseline for your win rate to forecast your net versus your gross.

❹ Have probability in place on deal records.

❺ Use a reporting mechanism to visualize your data, so that you have actionable insights.

Your forecasting is constantly evolving as your business does. It is not a set it and forget it process. It needs to be iterative and continued to be discussed with your sales team as a part of their job, so that you can all be working towards achieving a more accurate forecast.

How to Achieve Actionable & Accurate Forecasting Data